The tax and customs preferences, which are provided to the FEZ subjects, are the other attractive investment factor in addition to geographical location.

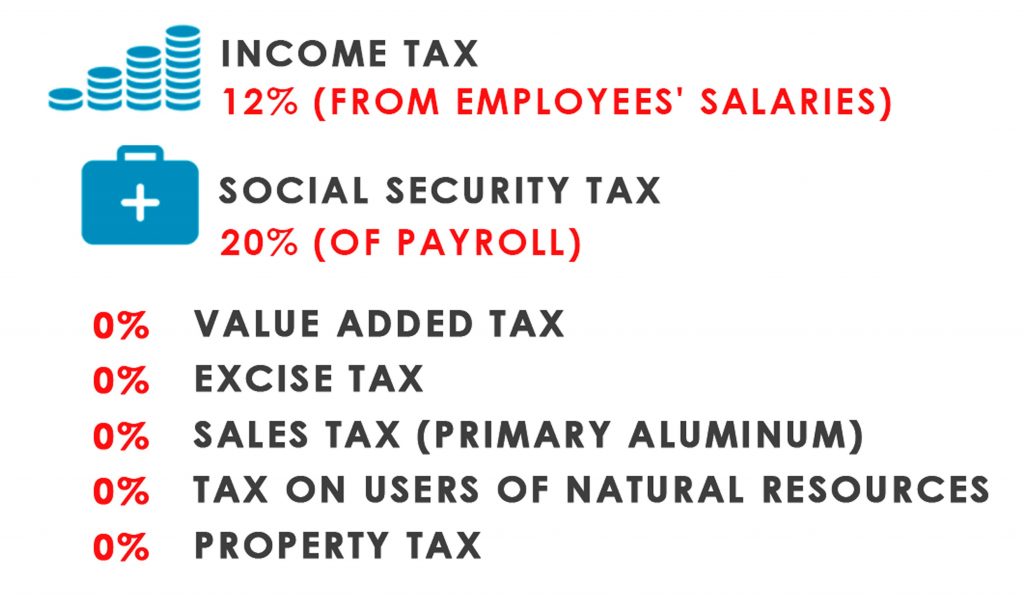

Entrepreneurship activity of FEZ subjects regardless the type of ownership is exempt from all taxes,provided in the Tax Code of Tajikistan, on FEZ territory except social tax (20%from payroll budget) and income tax from individuals (12%)FEZ subjects’ hired employees.

Profit received by foreign investors and the salaries of foreign employees given in foreign currency can be transferred without difficulties abroad and will not be taxed during transfer.